maine property tax calculator

Free means free and IRS e-file is included. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Property Taxes By State 2017 Eye On Housing

Excise tax is an annual tax that must be paid prior to registering your vehicle.

. 15 Tax Calculators 15 Tax Calculators. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Ad Look Up Any Address in Maine for a Records Report.

For comparison the median home value in Washington County is. The Maine Income Taxes Calculator Lets You Calculate Your State Taxes For the Tax Year. Max refund is guaranteed and 100 accurate.

Maine Income Tax Calculator 2021. This unit is responsible for providing technical support to municipal assessors. Our division is responsible for the determination of the annual equalized full value.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Find Out Whats Available. Calculate Understand Your Potential Returns.

- NO COMMA For. For comparison the median home value in Hancock County is. The Maine Property Tax Fairness Credit is available to low-income homeowners who paid property.

Calculating your Maine tax year income tax is similar to the steps we outlined on our Federal paycheck. The Municipal Services Unit is one of two areas that make up the Property Tax Division. Tax amount varies by county.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Maine property tax records tool to get more. Ad Free tax filing for simple and complex returns. The application is now available on the Maine Revenue Services website.

Guaranteed maximum tax refund. Enter your vehicle cost. If they prefer an application be mailed to them seniors can make the request by calling the Property Tax.

These rates apply to the tax bills that were mailed in August 2022 and due October 1. The following is a list of individual tax rates applied to property located in the unorganized territory. So the tax year 2022 will start from July 01 2021 to June 30 2022.

For comparison the median home value in Cumberland County is. Municipal Services and the Unorganized Territory. For comparison the median home value in Maine is 17750000.

Property Tax Stabilization for Senior Citizens also known as the Property Tax Stabilization Program the Program is a State program that allows certain senior-citizen residents to. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. After a few seconds you will be provided with a full breakdown of the.

The median property tax in Maine is 109 of a propertys assesed fair market value as property tax per year. Maine has a number of tax credits that benefit taxpayers in certain situations. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

The Property Tax Division is divided into two units. Property Can Be an Excellent Investment. Ad AARPs Calculator is Designed to Examine the Potential Return From an Investment Property.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Our Search Covers City County State Property Records. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Maine is ranked number twenty out of the fifty. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

See Results in Minutes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Maine has a 55 statewide sales tax rate and does.

Your average tax rate is 1198 and your marginal tax rate is 22. The Federal or IRS Taxes Are Listed.

Property Taxes By State 2017 Eye On Housing

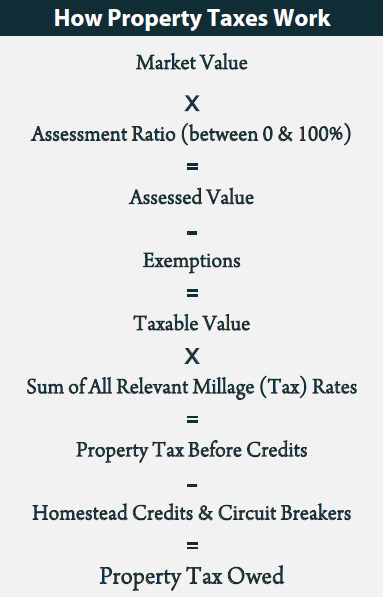

Property Tax How To Calculate Local Considerations

Maine Property Tax Rates By Town The Master List

2022 Property Taxes By State Report Propertyshark

Alameda County Ca Property Tax Calculator Smartasset

Maine Property Tax Calculator Smartasset

Paradym Fusion Viewer Beautiful Lakes Property Tax Boat Storage

Virginia Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

What Is A Homestead Exemption And How Does It Work Lendingtree

York Property Tax Rate Falls As Town S Valuation Climbs 15 In One Year Maine In The Fall Property Property Tax

Property Taxes How Much Are They In Different States Across The Us